During a recent webinar, Philippe Hupé, Frédéric Thienpont et Laure Virazels, tax specialists Walter France, have deciphered the main measures of the finance law concerning businesses, as well as other important measures that apply in 2023.

Staging of the imposition of equipment subsidies

Certain investment or equipment subsidies may be imposed in stages, at the rate of their depreciation. The finance law for 2023 extends this possibility of spreading to subsidies granted by organizations created by European institutions and to subsidies granted for operations enabling energy savings..

Young innovative company status : eight years for everything

From January 1, 2023, to claim the status of young innovative company (IF), the company must have been created less than eight years ago, instead of less than eleven years previously. This change in seniority has no impact on local taxes., the criterion of the age of the company being set at eight years since the origin. otherwise, profit tax exemption schemes, property tax and property tax for businesses attached to JEI status are extended by three years, until December 31, 2025.

Reduction in the corporate tax rate

The standard corporate tax rate is set at 25%., for financial years beginning on or after January 1, 2022. By exception, for companies which have achieved a turnover which does not exceed 10 million euros during the financial year or tax period, the tax rate is reduced to 15% within the limit of 42,500 euros (and no longer 38,120 euros) of taxable profit per twelve-month period, which is obviously more favorable to businesses. This increase in the limit from 38,120 to 42,500 euros should be applicable to financial years ending on or after December 31, 2022..

Corporate tax option period for sole proprietorships

A decree published in the official journal on June 28, 2022 specifies that the business manager has a period of three months, from the opening of its accounting year, to request assimilation to an EURL or an EARL and opt for IS. Which means that entrepreneurs closing on December 31 who wish to exercise this option this year must do so no later than March 31..

THREE AID SCHEMES TO LIMIT THE EFFECTS OF THE INCREASE IN ENERGY COSTS

These recent texts do not appear in the finance law, but are very important for businesses.

Third device : energy aid is aimed at all companies that consume large amounts of energy. It concerns all energies (electricity and gas). It was put in place in March 2022, more, fact, few companies could benefit from it, because the cost of energy had to be greater than or equal to 3% of the figure

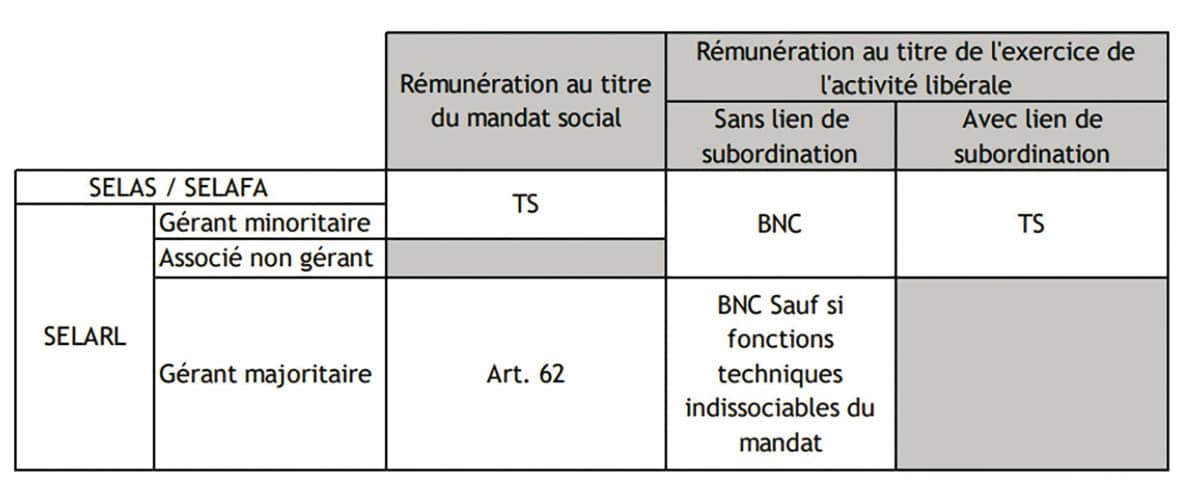

MODIFICATION OF TAX PROCEDURES FOR PARTNERS OF LIBERAL PRACTICE COMPANIES

Remuneration received by partners of independent practice companies (SEL) were until now taxable in the category of salaries and wages, by administrative tolerance. As for the majority managers of SELARL, they can get paid, either under their corporate mandate, either under an employment contract for their technical functions distinct from this mandate, their remuneration being assimilated to salaries and wages. The tax administration has canceled its previous administrative comments in order to align its doctrine with the case law of the Council of State for remuneration received from January 1, 2023. From now on, non-executive partners and corporate officers for their remuneration for the exercise of their technical functions will be subject to the non-commercial profits regime (BNC).

A new tax status

Let us remember that, for BNCs, income is considered the same as profit. This means that the non-managing partners, Firstly, will undoubtedly have to create an individual company and subscribe to a 2035 declaration with, at the key, the possible elimination of the 10% flat-rate reduction, and on the other hand that they will have to issue invoices to the company. The question of VAT will arise, as well as that of the deductibility of certain charges under BNC. These modifications are also likely to have an impact on the social security system of a certain number of liberal professionals.. This major change was planned for January 1, 2023. L’administration a toutefois pris conscience qu’un changement aussi important ne pouvait pas être aussi brutal. Il semblerait que ces professionnels pourraient conserver leur statut pour leurs rémunérations de 2023. Le changement n’interviendrait finalement qu’au 1er janvier 2024.

LES PRÉVISIONS ÉCONOMIQUES DE LA LOI DE FINANCES

Le taux de croissance du PIB, qui s’élevait en 2021 à 6,9 %, s’est établi en 2022 à 2,5 %, soit une baisse significative qui devrait, selon les prévisions du gouvernement, se poursuivre en 2023 pour atteindre 1,5 % avant de remonter très lentement. L’inflation, qui était très basse, 1,6 % en 2021, passe à 5,1 % en 2022. The government is banking on a downward return from 2023 to return to 1,75% in 2027. The public deficit, which was very important in 2020 and 2021, of the order of 8 to 9% of GDP, subsides slightly. In 2022 and 2023, it should be 5% and 2,9% in 2027. Finally, the public debt has risen above 100% and the government does not foresee a reduction for the years to come.

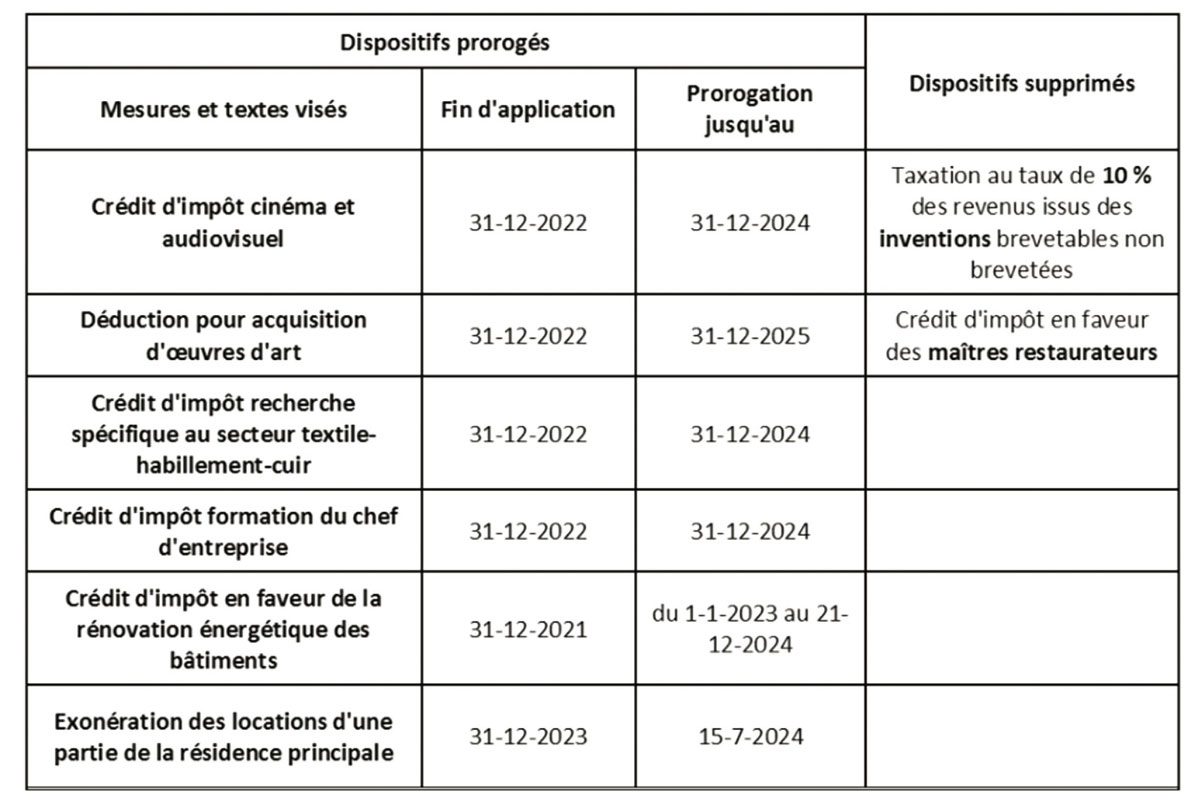

TAX REDUCTIONS AND CREDITS

Expansion of the scope of the sponsorship tax credit

Companies subject to income tax or corporate tax can benefit from, sous conditions, d’une réduction d’impôt sur les bénéfices au titre des dons consentis au profit d’œuvres ou d’organismes d’intérêt général, de fondations ou d’associations d’utilité publique, etc. From now on, pour les exercices clos à compter de 2022, la liste des organismes éligibles est élargie aux versements effectués au profit des communes ainsi que des syndicats intercommunaux de gestion forestière pour la réalisation d’opérations d’entretien, de renouvellement ou de reconstitution de bois et forêts ou pour l’acquisition de bois et forêts.

La TVA est désormais éligible sur les acomptes

As a reminder, VAT is payable for the provision of services when the price or deposits are collected (except option for debits) and for sales of goods upon transfer of ownership of the property (in practice, delivery). As of January 1, 2023 (deposits collected from this date), VAT becomes payable in the event of collection before delivery of the goods. There is therefore no longer any distinction made between deposits on services and deliveries of goods..

Transmission of a universality of heritage

Remember that transactions carried out between taxpayers are exempt from VAT when they are part of a universal transfer of goods. (contributions to society for example) and that the transferee undertakes to continue the activity transferred. The finance law for 2023, in order to bring French law into conformity with European law, provides fiscal security for operations concerning deliveries of buildings completed more than five years ago. This type of operation therefore also escapes taxation and VAT regularizations.. This provision will make it possible to avoid any regularization of VAT deducted previously..

Pay attention to the advanced deadline for the list of members of “TVA groups”

The finance law for 2021 had created a “TVA group” regime. It is in fact the counterpart, for VAT, of the tax integration regime for corporate tax. As of January 1, 2024, the date on which the representative of this single taxable person must transmit to the administration the list of members of the group is modified. Originally set for January 31, it is finally stopped on January 10. Clarifications are also provided concerning the VAT control methods for this type of group..

The electronic stamp, new way to meet electronic invoice obligations

The issuance of an electronic invoice requires that the authenticity of its origin, the integrity of its content and its readability are guaranteed, from its issue and until the end of its retention period. Compliance with these imperatives can today be achieved through three distinct means : electronic signature, the EDI structured message and reliable audit trail documentation. For documents and pieces established as of December 31, 2022, the finance law establishes a fourth means to ensure compliance with these imperatives, namely the use of the qualified electronic seal procedure within the meaning of European regulations. A future decree must specify the conditions for issuing and storing these invoices.

Transfers of individual companies assimilated to transfers of social rights

For the calculation of registration fees, transfers of individual businesses (or former EIRLs) having opted for the IS are assimilated to transfers of social rights - although, legally, there are no shares – at a rate of 3%. This rate of 3% is increased to 5% when the activity carried out by the individual company is predominantly real estate.. As for the basis of rights, it is made up of the net sale price of the loans contracted. Un doute subsiste sur l’abattement de 23 000 euros qui s’applique aux cessions démembrées de droits sociaux.

Suppression progressive de la CVAE

Pour améliorer la compétitivité des entreprises françaises, la loi de finances pour 2023 supprime la cotisation sur la valeur ajoutée des entreprises (CVAE) en deux temps :

– Pour les impositions dues au titre de 2023, les taux d’imposition sont réduits de moitié (taux d’imposition maximal ramené de 0,75 à 0,375 %).

– Pour les impositions dues au titre de 2024, la CVAE est supprimée. In parallel, le montant de la cotisation minimale de CVAE est ramené de 125 à 63 euros. On the other hand, le taux de la taxe pour frais de chambres de commerce et d’industrie (taxe CCI) est augmentée de 3,46 to 6,92 %. For the business property tax (CFE) due for 2024 and subsequent years, the cap rate is lowered to 1,25 %. For the impositions of the territorial economic contribution (CET) due for 2023, the cap rate is reduced from 2 to 1,625% in order to take into account the drop in CVAE rates.

Focus on tax audits

The right of communication exercised with regard to depositaries of public documents is subject to adjustments, from January 1, 2023, notably :

– justice commissioners are added to the list of professionals subject to the right of communication ;

– le droit de communication pourra s’exercer désormais sur place ou par correspondance, y compris par voie électronique ;

Finally, From now on, les entreprises qui établissent leurs documents comptables sur support électronique — c’est-à-dire aujourd’hui la quasi-totalité des entreprises — doivent conserver ceux-ci sous format électronique pendant six ans.

Une jurisprudence importante concernant le pacte Dutreil

Rappelons que les transmissions à la suite d’un décès, ou les donations de parts ou d’actions de sociétés ayant fait l’objet d’un engagement collectif de conservation (pacte Dutreil), sont partiellement exonérées de droits, à hauteur de 75 % de la valeur de ce qu’on donne. Au lieu d’être taxé sur 100 000 euros par exemple, le contribuable ne sera taxé que sur 25 000 euros, à condition que les titres soient conservés six ans. De nombreuses jurisprudences ont été édictées sur le point particulier des holdings animatrices. Pour bénéficier du dispositif, un arrêt avait jugé qu’il fallait que la holding soit animatrice au moment de la transmission. L’administration fiscale a modifié ce point et a indiqué que le côté opérationnel de la société doit désormais être effectif à compter de la conclusion de l’engagement collectif et jusqu’au terme de l’engagement individuel de conservation, c’est-à-dire durant six ans, et qu’elle ne change pas d’activité, notamment pour devenir une activité patrimoniale.

La mise en place de la facture électronique

La mise en place progressive de la facture électronique ne figure pas dans la loi de finances, mais il s’agit d’une profonde évolution de la vie des entreprises. Celles-ci doivent intégrer dès cette année leurs réflexions sur le sujet, afin d’être opérationnelles lors de la première échéance, en juillet 2024, qui marquera l’obligation pour toutes les entreprises soit de s’inscrire sur le portail public, soit de choisir une plate-forme PDP (plateforme de dématérialisation partenaire) afin de répondre à l’obligation, à cette date, de pouvoir recevoir des factures électroniques (à lire aussi sur ce sujet : la facture électronique, it's tomorrow, Leader Réunion no 219, December 2022).