Since the Pacte law, numerous changes to employee savings schemes have taken place. Among other provisions, employees can now monetize their rest days. The Absolute Human Resources working group presents the concrete methods of application.

New retirement savings plans (PER) offered to savers are the individual retirement savings plan (VERY), the collective company retirement savings plan (PERECO) and the mandatory retirement savings plan (But). The old retirement savings products will have completely disappeared on January 1, 2023. New rules make monetization easier. So, as long as the company has a PER agreement and in the absence of a time savings account (CET), the employee can transfer up to ten days of rest not taken per year to their PER. If the company has a time savings account agreement which provides for it, he will be able to transfer his rights acquired in his CET to his PER within the limit of ten days per year. In both cases, the employee can transfer his RTT to his PER - if the regulations thereof provide for it -, his paid leave, its conventional days and its recovery days.

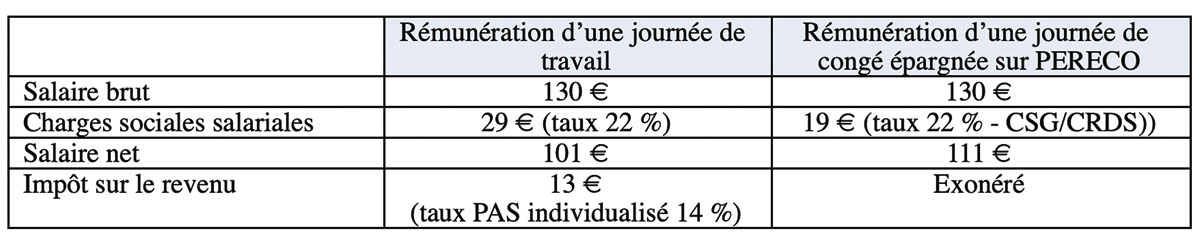

The transferred days benefit, within the limit of ten days per year and per beneficiary, an exemption from income tax and an exemption from employee Social Security contributions. The other contributions remaining due are : work accident, autonomous solidarity contribution and Agirc-Arrco supplementary pension. Company contribution (if the employee benefits from it) is exempt from social charges (hors CSG-CRDS) and income tax. Capital gains and savings income are exempt from tax (excluding social security contributions for investment income at a rate of 17,20 %).

Blocked amounts with the possibility of early release

The saver will recover the sums invested upon retirement., the sums being blocked until then. However, there are cases of early release of invested sums :

• death (of the employee, of their spouse or PACS partner) ;

• disability (of the employee, of their spouse or PACS partner, of his children) ;

• over-indebtedness of the employee ;

• acquisition of the main residence ;

• restoration of the main residence following a natural disaster ;

• expiration of employee rights to unemployment insurance. No deadline is required for the early release request. There is an exception for the purchase or renovation of the main residence, for which the deadline is six months.

A CONVERSION IN THE FORM OF SUPPLEMENTAL REMUNERATION

Leave days are converted into additional pay if the employee has allocated leave days beyond the five weeks of annual leave.

*Pacte Law of May 22, 2019 (law no. 2019-486) supplemented by decree no. 2019-862 of August 20, 2019.