While the overall consumption of food products contracts, a product escapes the trend : the egg. Over the first two months of 2023, its sales in mass distribution have even increased by 5,9% in volume compared to the same period last year. A study by the National Committee for the Promotion of Eggs (CNPO), the egg interprofessional association, also confirms the dominant place of so-called “alternative” eggs, from cage-free hens.

A must-have product in the kitchen

In 2022, each French person consumed 220 eggs overall, totaling the eggs used by consumers, out-of-home catering and agri-food companies. In this consumption, the share of egg products amounts to 35%, shell eggs used in out-of-home catering at 20% and, finally, household purchases in stores by 45%. The total egg consumption of each French person is therefore more than four eggs per week., whether at home or away from home, in the form of egg product or shell egg. In 2022, household purchases thus increased by 0,7% compared to 2021, driven by the increase in purchases of eggs from chickens raised on the ground (+ 23,3 %) and outdoor (+ 6,4 % hors label Rouge). In 2023, over the first two months of the year, household purchases of eggs increased by another 5,9% all farming methods combined, compared to the same period of 2022.

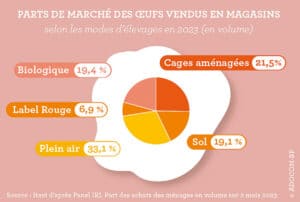

Alternative eggs : almost eight eggs out of ten purchased

In 2022, alternative eggs accounted for more than three-quarters of eggs purchased in stores (75,2 %). Over the first two months of 2023, they rose to almost eight out of ten (78,5 %). Free-range eggs (hors label Rouge) come first in this category, with 33,1% market share over the first two months of 2023 (30,5% for the year 2022), followed by organic eggs (19,4% over two months of 2023 and 20,3% in 2022), then eggs from chickens raised on the ground (19,1% over two months of 2023, 17,9% in 2022) and Red label eggs (6,9% over two months of 2023 and 6,6% in 2022).

The increase in egg sales in mass distribution is driven by the growth of alternative eggs, with a record increase in sales of eggs from free-range hens. The latter recorded the highest increase in sales : +65% over the first two months of 2023 compared to the first two months of 2022 (+23,3% and 2022 vs 2021), followed by free-range eggs (+33,6% over 2023 ; +6,4% in 2022) and the Red label (+5,4% in 2023, -3,6% in 2022). Sales of organic eggs, after falling back by 5,8% in 2022 compared to 2021, appear to stabilize at the beginning of 2023.

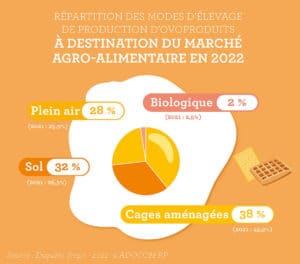

Also in the food business and out-of-home catering market, the production of egg products from eggs from hens raised in cages will become a minority in 2022. From now on, 53% of egg products are made from eggs from alternative farms (36% in 2019, 47% in 2021). In out-of-home catering, we can note that it is the outdoor volumes which increase the most in 2022 : 11% in 2022 versus 8% in 2021. Organic volumes consumed increase slightly (5% in 2022 ; 4% in 2021), while the ground stabilizes at around 8%. For manufacturers of food products made with eggs, it is mainly the volumes from free-range hens which record a significant increase in 2022 : 32% in 2022 versus 26% in 2021. Free-range eggs pass, as far as they are concerned, from 26% in 2021 to 28% and organic remains stable : 2,5% in 2021 and 2,3% in 2022.

The transition of breeding methods underway