Faced with the unstable economic context, consumers are turning to the safe haven of snacking, but by adapting their choices and behaviors. This is what the Speak Snacking study shows, made for Sandwich lounges & Snack Show, in partnership with the research firm Strateg’eat.

Faced with the unstable economic context, consumers are turning to the safe haven of snacking, but by adapting their choices and behaviors. This is what the Speak Snacking study shows, made for Sandwich lounges & Snack Show, in partnership with the research firm Strateg’eat.

The decline in purchasing power

It impacts consumer wallets, both in terms of attendance and average basket and on popular circuits, particularly in table catering. Indeed, 41% visit catering outlets less often (including 53% core consumers and 54% Gen Z). 17% have reduced their attendance at lunchtime and 13% in the evening, and 41% moderate their out-of-home consumption actions. The effect of teleworking, if it tends to decrease, still weighs.

The search for new points of sale

We also notice a drop in the average shopping basket (15% of respondents frequent the same points of sale, but have reduced their average basket) and a drop in the quantity of foodstuffs (several of them reduced their order : desserts for 14%, alcohol for 13% and aperitif for 12%). This market context therefore favors the snacking offer in consumers' choice of out-of-home consumption activities.. Furthermore, 6% of respondents choose new, more affordable points of sale in terms of average basket price, and 7% go more to bakeries and fast restaurants. In total, 69% of respondents decided to turn to supermarkets and bakeries, more economical circuits and big winners.

Supermarkets and bakeries are gaining weight

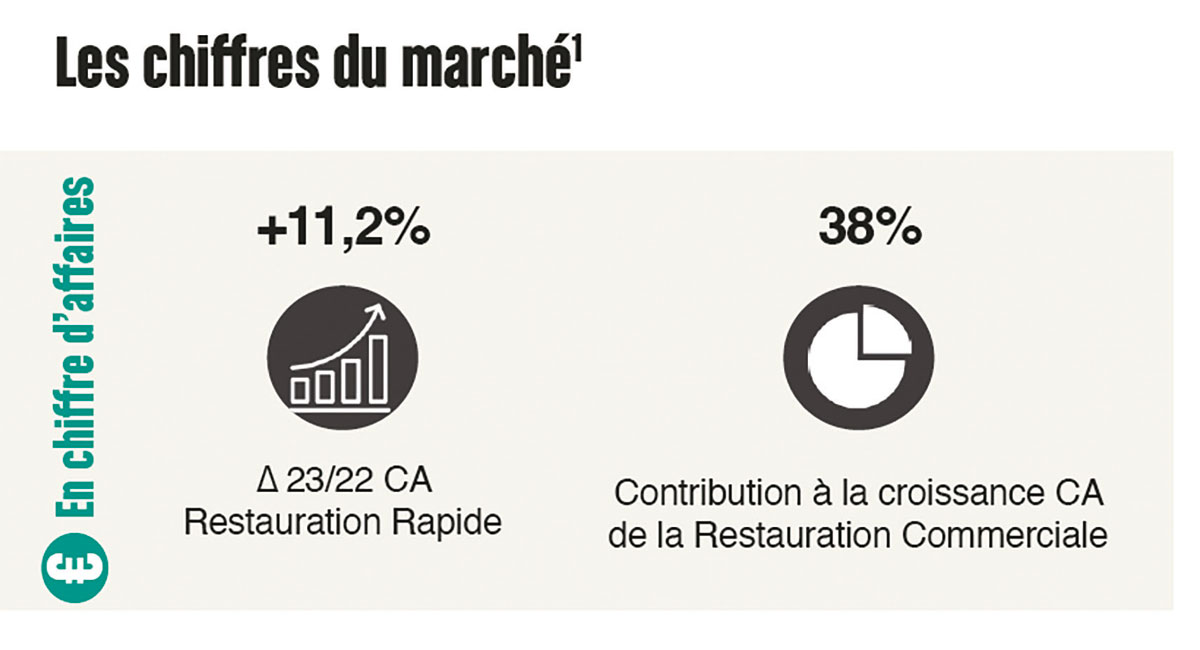

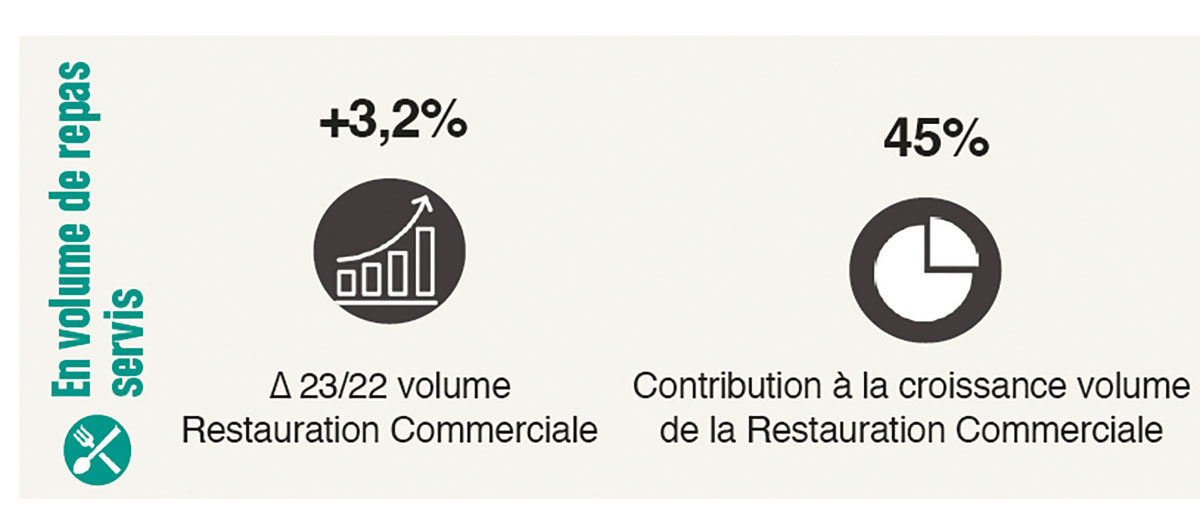

The supermarket and bakery circuits are therefore gaining importance within a globally growing snacking world.. The current period favors the increase in small and large supermarkets for lunch solutions (23% in 2024 versus 19% in 2023) and allows the bakery to maintain itself (18 %). The distribution of dinners works in favor of the bakery (11% in 2024 versus 3% in 2023) you are from the GMS (17% in 2024 versus 8% in 2023). For Béatrice Gravier, director of Sandwich lounges & Snack Show et Parizza, “the behavioral changes observed are logical in this context of withdrawal, but temporary, because linked to a more difficult end of the year after several months of growth in 2023. To alleviate the crisis, it is necessary to focus on innovation and quality”.

THE MUE SNACKING LANDSCAPE

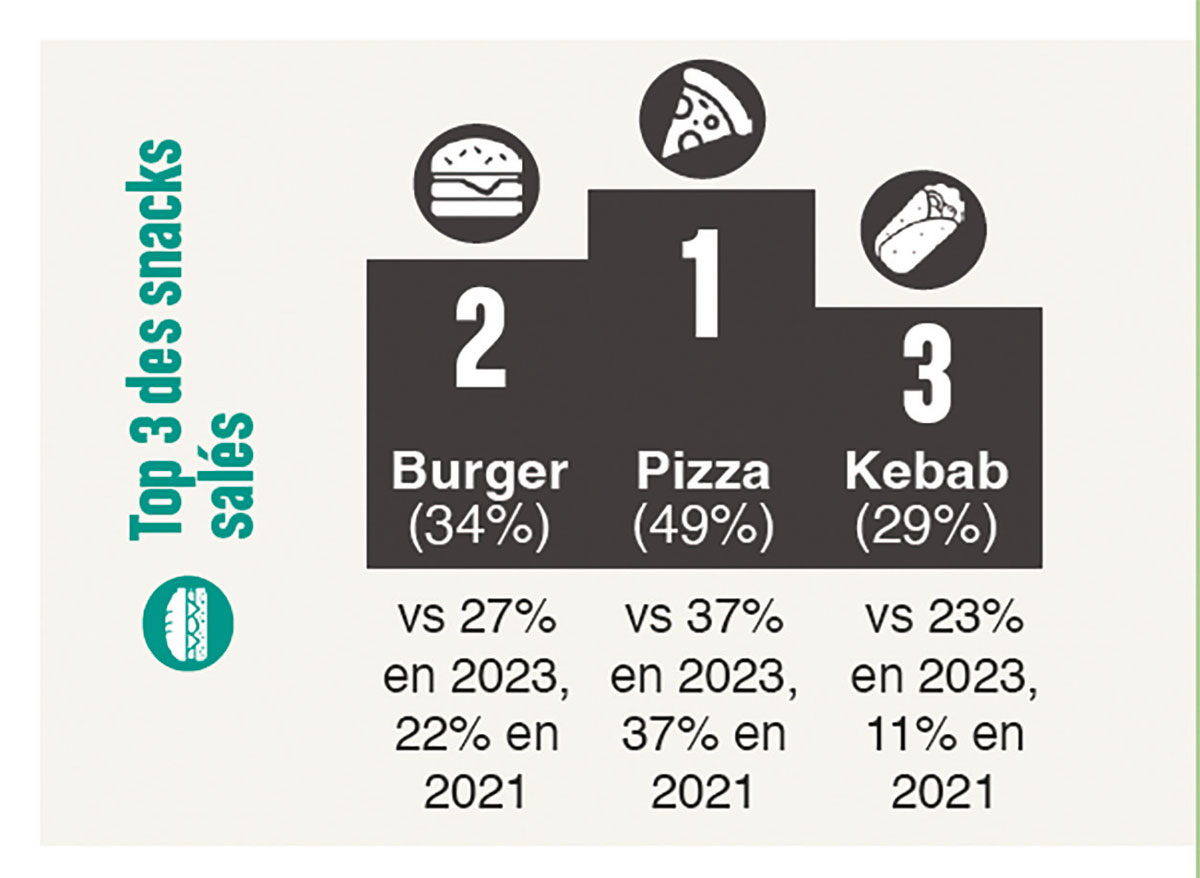

The emblematic top 3 of snacking is no longer. From now on, these are the pizzas, burger and kebab which are among the favorite products of the French. No more sushi which took third place, but which is no longer innovative and economically competitive enough. Sushi is now even out of the top 10, but is offset by the progression of many other Asian offers which are not yet in the top 10, but take up more and more space. All savory snacks have progressed in the hearts of French consumers with a search for variety and curiosity.

Price pressure : new consumer decisions

Faced with difficulties, the majority of consumers have already adapted their behavior. Even if we see an overall increase in the average budget (€39 per week at the start of 2024 compared to 36,€40 in 2023) due to inflation, the consumer makes choices to reconcile his purchasing power and his pleasure.

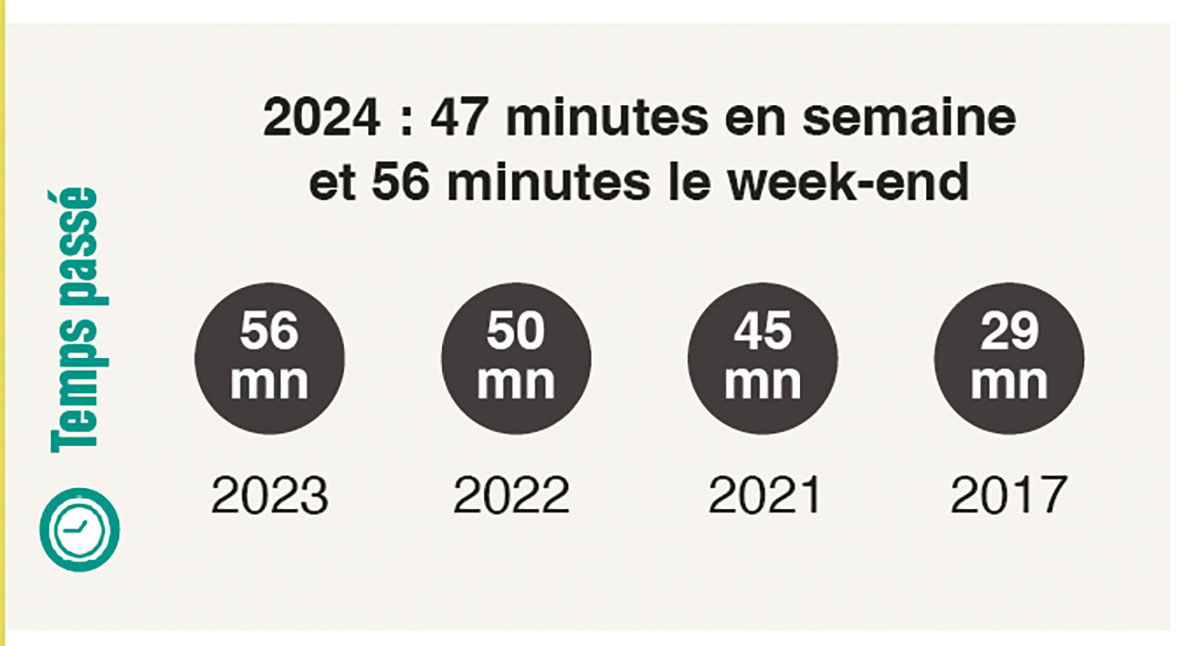

Today, the French estimate that the price they can spend is 10,€50 for a burger, of 13,25 € for a pizza and 9,€20 for a kebab. We thus observe the premiumization of certain foodstuffs : burger, pizza (which exists in fast food version and fast casual version), as well as the craze for kebab. There is still room to push consumers to premiumize with the right arguments : innovation, experience, quality of ingredients, story to tell… Consumers continue to take their time during their lunch break, the weekend (56 minutes in 2024), but tend to reduce the latter during the week (47 minutes at or near the workplace, and 39 minutes teleworking). A rather shorter duration which requires vigilance and actions to never make the lunch break too functional. Reassuring phenomenon : Generation Z is more willing to take their time with 65 minutes on the weekend, 56 minutes in the workplace and 45 minutes teleworking. You should also know that 27% of French consumers choose a snacking place thanks to the quality of its ingredients and service., and 19% choose it for its atmosphere. Finally, the majority of consumers think that restaurateurs have not been proactive enough in the face of inflation : they increase their prices without changing anything, with little loyalty, few promotional actions and little transparency in the end.

THE STRATEG’EAT STUDY

Online consumer study on at least 1,000 consumers on the weekly out-of-home consumer journey. Survey carried out from January 8 to 15, 2024. Analysis also carried out with market data from Gira Foodservice-Circana.