“How is the cash flow of self-employed people managed??» This is the question that Yomoni asked herself, leader in online savings management, by interviewing 1,002 people carrying out an economic activity with the status of self-employed workers : regulated or unregulated liberal professions and freelancers, autoentrepreneurs, micro-entrepreneurs.

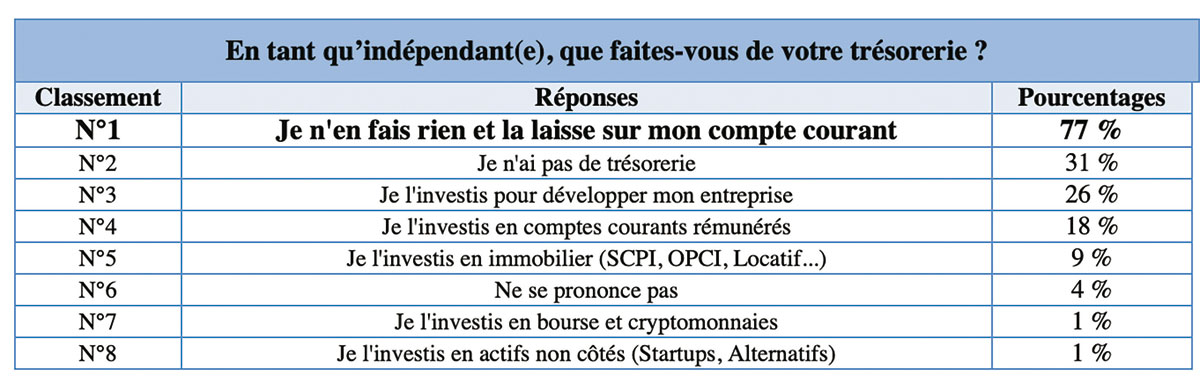

The independent treasury lives up to its name and seems well hidden… Indeed, for more than 77% of self-employed workers, the cash remains quietly in a current account. A sum which therefore brings in nothing and even causes you to lose money each month taking into account inflation. The only virtue of this action would therefore simply be to “reassure” professionals. For 31% of independents, the question does not even arise, since they declare that they do not have any spare money available. In third place in the ranking, 26% use a little of their cash flow to invest and develop their business. However, more than 71% of self-employed people would like to grow their cash flow, but have no idea how to proceed. What’s more, 22% say they “absolutely” want to do so., thus demonstrating a strong desire to use this money more actively. Among all the reasons that can prevent self-employed people from using part of their cash flow, it is the fear of losing part or all of this sum that comes first for more than 62% of them. There is also a lack of confidence in the investment solutions offered for 17% of respondents. Finally, 12% severely lack financial knowledge and admit to not knowing that cash investment solutions exist.

Two out of three self-employed people worried about their retirement

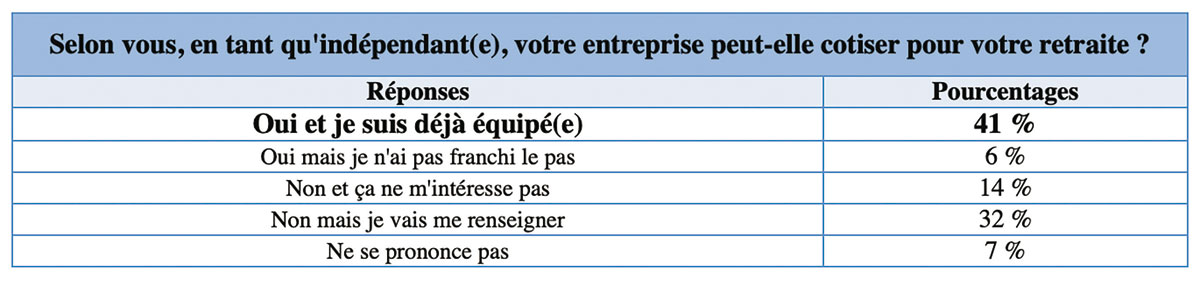

People carrying out a professional activity on their own do not seem to see the end of their career looking rosy at all... To the question : “As an independent(e), how do you feel about your retirement? ? » Nearly 25% say they are “worried” and 41% “very worried” ! Only 11% say they are “very confident” and 21% “moderately”. A vision of the future that is not very reassuring overall, but which is not taken head-on by the independents. Only 49% of self-employed people have set up a retirement savings plan. And if 43% didn’t do it, 8% don't even know if this is the case or not... The lack of knowledge about retirement-related systems seems obvious when only 41% of self-employed people admit to knowing that their small business can contribute to their retirement : 6% are aware of this possibility, but have not yet taken steps in this direction and 32% are unaware that their company is able to ensure these contributions and are keen to find out (14% are not interested in these questions). Finally, freelancers are not all in the same boat when it comes to accounting : 9% say they are very well advised by their accountant or chartered accountant, 14% consider they are less well guided. More problematic, 49% admit to not being advised at all by an accounting professional.