Number one in the marketing of business real estate in Reunion, the real estate consulting and services company Inovista made itself known outside its professional scope by making public, from 2014, an enlightening annual summary of the corporate real estate market and its impact on the economy, even on everyday life. These summaries are a reference today for many decision-makers and planners.. It seemed interesting to us, as the end of 2024 approaches, to question Vincent Le Baliner, co-founder of Inovista, on his activity, but also on the lessons revealed in recent years by the syntheses. What does the Reunion corporate real estate market tell us about the economic situation?, on business expectations, on the evolution of trade, on price formation, on the ecological transition, on land use planning ? The educational concern of this annual data demonstrates the company's desire to align the interests of its customers with the general interest., to act for the territory. We are not surprised, in these conditions, that Inovista embodies a certain management style, a way of thinking about teamwork. Numbers, facts, comments, a global vision and a lot of common sense make this exchange with Vincent Le Baliner particularly instructive.

celebrates his 14th birthday. From what observation was the company born? ?

Vincent Le Baliner : We need to put ourselves back in the context of fourteen years ago. The 2008 crisis marked the end of the “Thirty Glorious Reunion Islands” and its growth rates of 5% to 6% per year. With this crisis, a lot of actors have disappeared, but new actors have appeared. I arrived professionally in Reunion in 2009. At the time, on the island, real estate ownership was essentially linked to operational needs : a company was an owner because it needed premises to work. If this need disappeared, she rented or resold and little or not asked herself the question of the creation of real estate value. Elsewhere, everywhere in developed economies, real estate property is held by actors whose job it is : institutional investors, pension fund, assurances, etc. Operations side, when you are looking for 200 m2 of offices or commerce, you call a real estate advisor, which shows you what is available. Not in Reunion in the years 2009-2010 : you had to buy Le Quotidien on Thursday for the classified real estate ads, watch on Clicanoo, contact social landlords, etc. ! The crisis has made Reunion Island aware of the interest in corporate real estate also becoming a creator of value. Inovista was born from this observation and the need to support players in the transition towards a structured supply and demand for professional real estate..

How has Inovista evolved to become the Reunion reference for corporate real estate? ?

To describe this evolution, I would say that we worked around five values. The first one, it is the requirement towards ourselves. The second, perfectionism : we get to the end of things. The third, transparency : say what you do and do what you say. The fourth, proximity : be closest to real estate assets. The fifth, it's independence. Independence allows each file to be managed without conflict of interest. This approach to our profession comes from the Anglo-Saxon professional culture, that my partner, Nathalie Khau, and I share. We were born professionally with these values. This is what allowed us, I think, to grow peacefully.

To grow, it's a thing, but become a benchmark company ?

The second axis that makes us what we are today, is that we have always thought about the development of our professions, of our services, of our tools, for our customers of course, but linked to the territory and its needs. Telling ourselves that we contribute to something bigger than ourselves gives meaning to our work. Another success factor : training our teams. Their knowledge is constantly updated. Finally, there are our societal commitments. Gender equality : no difference, among others, salary with us. And of course “the return pei” : I can no longer count the employees of Reunion Creole origin who left for mainland France or elsewhere that we hired on their return to Reunion. I consider them an opportunity. Next January 1st, there will be 23 of us in the team. With us, everyone is an employee. We do not employ independent salespeople.

What does the notion of services and advice in commercial real estate cover? ?

Our historical profession, it’s marketing. We enhance assets and secure property owner transactions, of real estate developers. In this profession, we represent, depending on the years, 40% to 50% market share. In fourteen years, we completed 750 transactions, we have rented or sold nearly 320,000 m2, i.e. 10% of the professional real estate stock in Reunion Island. Our pride, is that none of our customers felt wronged, Never. We are recognized for our high integrity in the matters we follow. Our second job, arrived a little later, it’s rental management. It covers the protection of the lessor against its five major risks : legal, technique, financier, commercial and environmental. The goal is also to improve the net income of the building and the value of the assets.. Finally, we provide service to tenant users and we support the ecological transition of buildings. We currently manage 150 buildings housing 400 tenant companies from almost all areas. : retail, wholesale, industry, transformation, consular representation, tertiary activity. Our growth in this business is very significant.

Inovista goes public, every year, a summary of the professional real estate market in Reunion and Mayotte. Why did you take this initiative? ?

This comes from our third profession : advice and research. Thanks to our analysis tools, we have acquired very detailed knowledge, both structural and cyclical, of the real estate stock and dynamics of the territories of Reunion and Mayotte.

This analytical capacity allows us to make recommendations to owners of real estate or land assets.. We can also carry out market and programming studies relating to land or a neighborhood on behalf of private or public actors.. For public actors in Reunion, from Mayotte, of the Antilles and Guyana, we have recently become a subcontractor of the “real estate consulting” market of the Union of Public Purchasing Groups (UGAP), the community purchasing center. A new possibility to move forward, better and faster, the different projects. Our first summary made public dates from 2014. At the time, there was no data on business real estate in Reunion. This first study focused on the structural data of the park : number of square meters location, types of assets, construction dynamics. This structural database allowed us to subsequently carry out economic analyzes. Knowing the structural and the cyclical, we were able to produce indicators, such as the vacancy rate and absorption times ; indicators that existed in other regions of France, but not in Reunion. Comparisons became possible. Make our annual studies public, it’s concretizing the commitment to the territory I was talking about. Contribute to ensuring that decisions are based on authoritative data and not more, if I may say so, depending on the direction of the wind... We communicate widely about this work so that it is useful to everyone. We have also been doing it in Mayotte for three years.

The 2023 summary showed a sharp decline in the number of projects and constructed areas in Reunion Island. Is commercial real estate still in crisis? ?

Should we talk about a crisis? ? The observation is as follows : decline in construction starts, drop in requests, but maintaining transactional activity. Construction starts depend on three things. First : the cost of construction, and it literally exploded due to the global rise in prices of materials and transport, to which is added the dock dues in Reunion. Secondly : the borrowing capacity of buyers, and the rise in interest rates last year reduced the borrowing capacity of businesses by 30% to 40%. Thirdly : Reunion demand. Today it is mainly rental, at 70%. But the job of a promoter, is to sell the buildings he builds. These three factors combined make it difficult to meet supply and demand for commercial real estate.. Although the transaction volume remains significant, demand is overall down 40% in 2024. This is a cyclical effect linked to the current business climate : companies postpone their expansion plans. However, we have totaled in recent months, at Inovista, 250 business premises search projects. The demand stock with us amounts to approximately 370,000 m2. The construction crisis is also weighing on the corporate real estate market. The launch next year of several major economic development projects should improve things.

Is this situation shared by all types of commercial real estate or are there degrees in this decline? ?

Demand remains very strong for logistics and production premises. It remains supported for quality offices, having a good level of service. It is in commerce that demand recorded a sharp drop. In 2023, 100,000 m2 of retail space was put on the market, while the request expressed represented 70,000 m2. This is the first time, we have been monitoring these indicators since 2015, that there is an inversion of the relationship between supply and demand in commerce.

Regarding trade, a summary from Inovista seemed to mean that the overall commercial surface area was too large in relation to the number of inhabitants to ensure the viability of all commercial enterprises.

We will soon update our structural study on the real estate stock. I give you exclusively our first estimates. We believe that the retail park today represents 1,8 million square meters. Or 2 m2 per inhabitant. In a city, the average is around 1 m2 per inhabitant. We therefore have twice as many square meters of commerce locally as in France.. Four phenomena explain this development : insularity, with the obligation to consume on site, the desire to consume, finally the division of the territory. The scale of distances is particular. In which other region of France do you have two hypermarkets under the same brand three kilometers as the crow flies? : nowhere. But here you have a natural border called the Rivière des Galets. As a result of this division, a large number of businesses have opened almost everywhere.. Finally, we must cite political will. Let's go back to the 1980s, for RHI operations : the politicians of the time were wondering about ways to create jobs for people who were going to live in social housing. On a, in this perspective, created at the foot of buildings of numerous commercial spaces.

You see it as a cause of the current difficulties of local commerce ?

What is certain, This is because the multiplication of surface areas does not lead to the multiplication of turnover, contrary to what some people wanted to believe. Turnover shifts, it does not multiply. Creating commercial behemoths at the entrance to cities does not boost city center commerce. For the rest, there are other reasons for trade difficulties. Competition from online commerce : consider that, two years ago, La Poste received around four million letters and 700,000 parcels per year in Reunion.. The renewal of commercial proposals is also in question. There is also the lack of animation and densification of city centers. The city centers of Reunion Island ultimately remained relatively sparse.. Another reason, it is of course consumer expectations that have evolved.

Price inflation is one of the big topics of the moment. Is there a link with real estate costs? ?

Each merchandise sold includes three real estate costs. That of the warehouse where it is stored, that of the premises where the processing takes place and that of the business where it is sold. However, in Reunion we have some of the highest rental values of business real estate in Europe. ! The square meter of warehouse in Reunion Island is greater than that of the warehouses at London Heathrow Airport ! The rental value is between €11 and €15 per square meter in Reunion. In Marseille, it’s 7 to 9 €. There are fewer square meters of warehouses in Reunion than in Besançon, city of less than 200,000 inhabitants which is located far from port terminals. For production premises, rental values in Reunion are two to three times higher than those in mainland France. In the meeting, the real estate charge, property and other taxes included, represents between 3,5% and 12% of a company’s turnover. I am surprised that, among the organizations that have previously looked into the causes of the high cost of living, no one has asked this question. In my opinion, the cost of real estate is a component of the consumer price.

Is Reunion Island lacking in activity zones? ?

There are 500 ha of unused economic land in the PLUs of Reunion. What is the issue with ZA ? It's the job. When a business is looking for real estate, it’s to grow, so to hire. In 2022, our study converted business needs into number of jobs. The needs represented 10,000 jobs on hold. Reunion has 130,000 job seekers. On the creation of activity zones we see that, in the southern microregion, CIVIS and CASUD worked a lot, with the opening of the Pierrefonds activity zones, DAY 4, ZA des Palmiers, ZAC Les Terrass. The CASUD and CIVIS territories account for 50% of building permits. On the Eastern microregion, the new mayors of Saint-André, de Bras-Panon and Saint-Benoît are working to free up land to develop economic activity. These are territories where, tomorrow, we will be able to build and bring living spaces closer to workplaces.

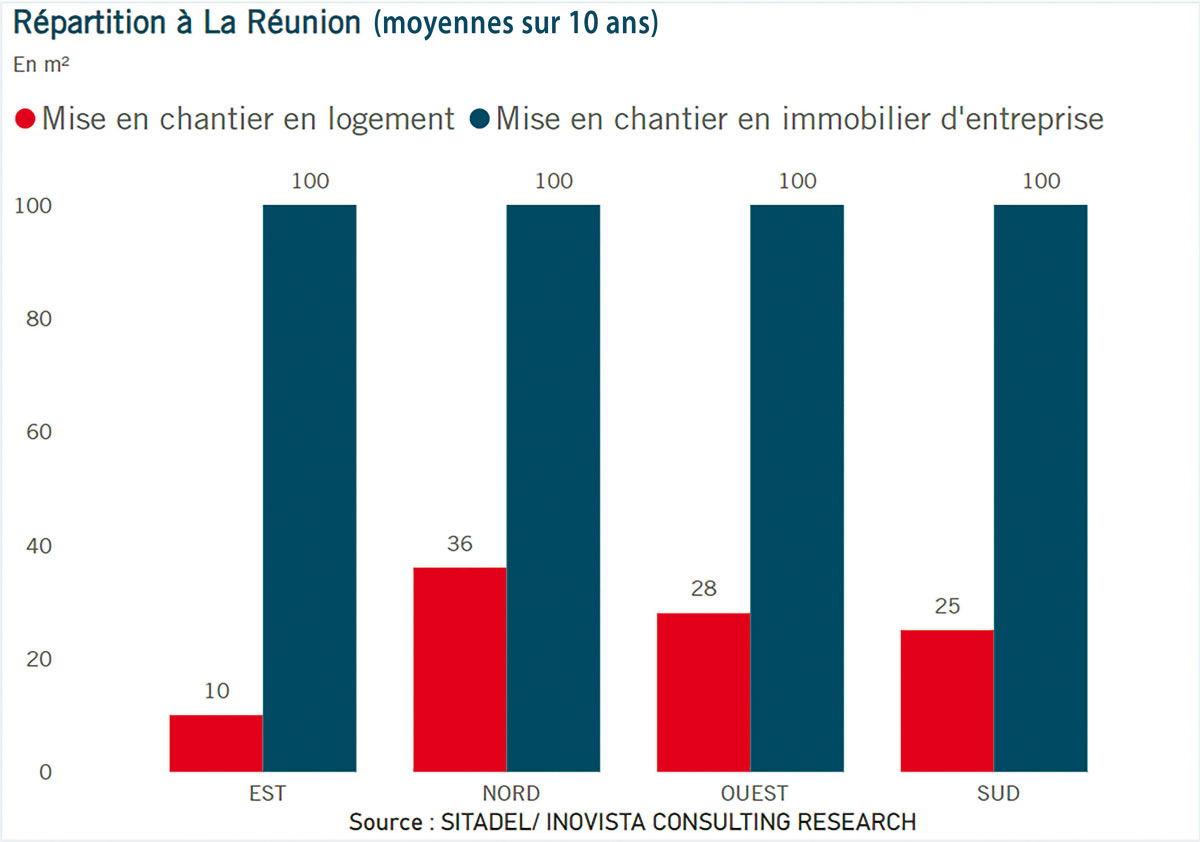

and production of commercial real estate between the East and the North.

What is the influence of consumer expectations and consumption patterns on commercial urban planning? ?

Commercial urban planning has experienced a real slowdown with the Climate and Resilience law. Almost all commercial development projects have been stopped. The law severely limits CDACs. We also note the significant vacancy of businesses at the foot of buildings in social housing districts.. A number, rue Maréchal-Leclerc in Saint-Denis : between the bittern and the ocean space, the commercial vacancy rate is between 40% and 50%. Some city centers are experiencing vacancy rates of 30% to 40%. This means that these commercial premises will have to be reconverted to accommodate other activities or uses.. If the commercial fabric weakens, the artisanal fabric strengthens. How many artisanal companies of two or three people are unable to accommodate their activity because nothing exists for them? ? The old commercial cells will never again attract traders. Why not allocate them to welcoming small production SMEs? ? This raises questions of standards, noise, waste management, etc., but it is one of the challenges of tomorrow. Wider, we enter the entertainment culture. There is a wait. Site reconversion work will be carried out at this level. It's obvious.

Judicial liquidations, currently increasing, free up surfaces. Do they have an impact on the real estate market? ?

If the establishment is not an employer, it has no impact on the corporate real estate market, because there is no surface release. For employing establishments, oui, it has a real impact. Especially since, in commerce, a liquidation has an almost immediate contagion effect on other businesses. A site immediately loses attractiveness. But a liquidation also redistributes the cards. Beyond a surface, it frees up a market and allows another player to develop. Judicial liquidations have, for us, another consequence : you should know that a judicial liquidation no longer automatically ends the commercial lease. This is an additional reason, for owners, to entrust us with the management of their buildings in order to minimize their risks.

Since 2022, owners of tertiary buildings are expected to communicate, every year before September 30, their energy consumption from the previous year on the Ademe Operat platform. The tertiary decree provides for a 40% reduction in the energy consumption of business premises located in buildings of more than 1,000 m2 by 2030.. Do you have an overview of what has already been done in this area? ?

Our advisory and research service has estimated the number of buildings concerned : 1 380, and 5,000 businesses in these buildings. That means it concerns a lot of people. Of these 1,380 buildings, Inovista manages 50. The consumption reduction objective is 40% in 2030, 50% in 2040 and 60% in 2050 ; 40% in 2030, that is to say almost in five years. It would be interesting if Ademe published data on the number of companies appearing on the Operat platform. Today, we have no vision. The other problem, it is the “method” decree which must set theoretical reference consumption values for Reunion Island. We are asking to reduce energy consumption by 40%, All right, but compared to what reference ? The legislator always knew that the declaration on Operat to set reference thresholds could pose a problem. This is why it was decided to set values by type of asset and by department., on which companies can rely. These values are known in France, but not yet in Reunion. Waiting, at Inovista, we refer to the values of Marseille and Bouches-du-Rhône. Concerning the tertiary decree, I don’t think that the planned fine of €7,500 will be a driving force for businesses. The name and shame system, that is to say the publication of the names of bad students, provided for in the law is much more restrictive. But the real issue will be the devaluation of assets which have not implemented measures to reduce their energy consumption. Another question remains unanswered, It’s who should pay what. The obligation is made to the owners of the building, but the reduction in energy consumption will benefit tenants. The texts have holes in the racket : they don't say anything about it. The fact remains that the energy consumption of buildings is becoming an issue in rental negotiations..

Inovista was at the initiative of a notable round table on the spatial planning issue represented by corporate real estate to bring the workplace and home closer together.. Did it provoke reactions ?

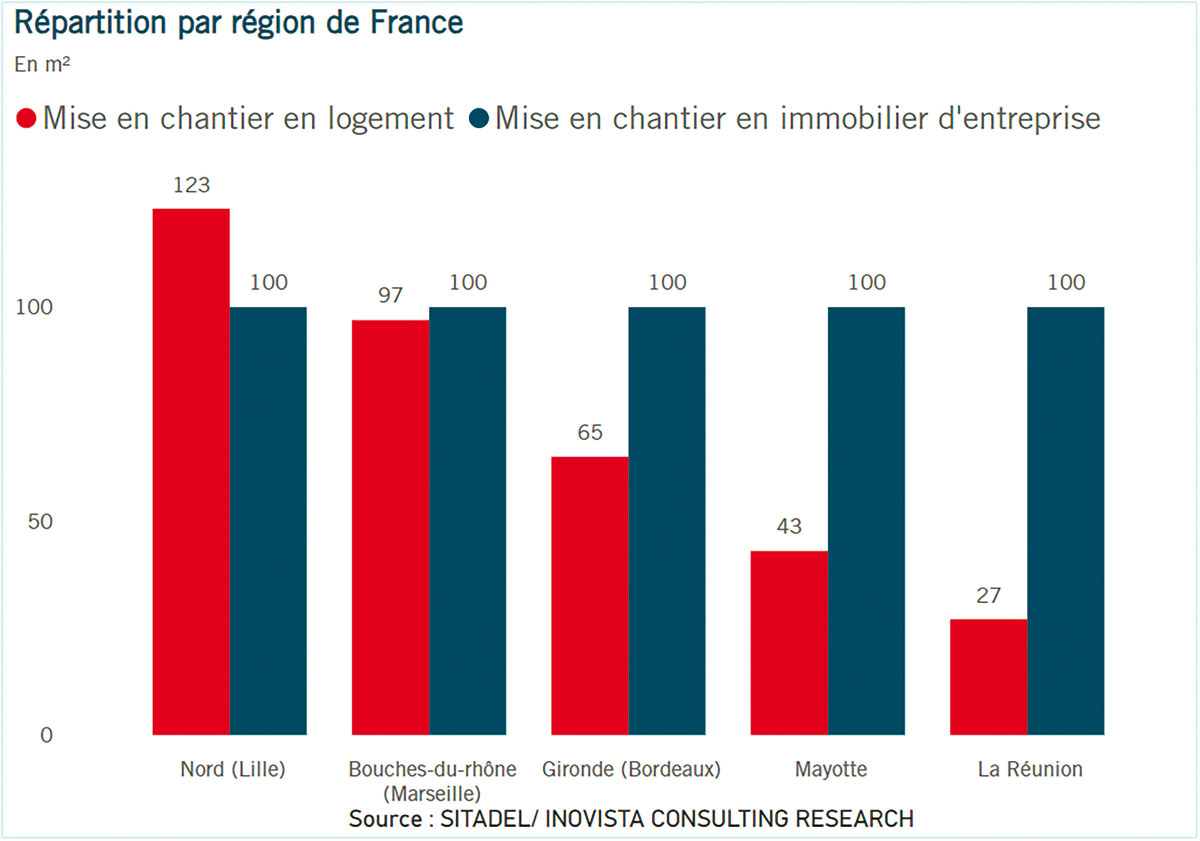

A city has three real estate functions : to find accommodation, work and produce, consume and entertain. A balanced city is a space where, when we produce a square meter for housing, we produce one square meter of real estate for the rest. Marseille : one square meter of housing, one square meter of business real estate. Lille, The same. Bordeaux : 100 m2 of accommodation, 65 m2 of business real estate. In the meeting, over the last ten years, per 100 m2 of housing, we produced on average 27 m2 to work, consume and entertain. The micro-region where the most housing has been built is the one where proportionally the least business real estate has been produced., ballast : 10 m2 of business real estate for 100 m2 of housing. The northern microregion, she, built 36 m2 of real estate for 100 m2 of housing. All this causes pendulum movements between micro-regions. These choices date back ten to fifteen years. And political time is not that of planning. Ten years ago, the daily morning traffic jam at the eastern entrance to Saint-Denis did not exist… I am willing to bet that you will have the same traffic jam tomorrow between the West and the South, because one square meter in two of business real estate will be concentrated in the Saint-Pierre–Le Tampon area in the coming years. This question is unbearable, and its consequences are considerable. Take the case of a couple who must travel two to three hours each day between work and home. The organization of family life, monitoring children's homework, the availability of parents for their children, is upset. With such imbalances, we are creating the inequalities of tomorrow. The one who grows up with available parents, not stressed, will have more luck in life.

You are also president of the Real Estate Club behind the creation this year of a BTS in real estate professions on a work-study basis in partnership with the Reunion training institute. Real estate companies and agencies are understaffed ?

Setting up a real estate operation requires between 40 and 50 operators : architect, financier, lawyer, notary, constructor, investor, design and control office, etc. Operators who, most of the time, everyone works in their corridors. This is the observation at the origin of the Real Estate Club. And quite quickly, we asked ourselves how to transmit the best practices of our professions ? The real estate-construction sector, which represents around 20 points of Reunion’s GDP, lack of skills. We have chosen to act by setting up this work-study BTS to prepare young people for our professions. This is the first stage of the rocket. We are working on creating one or two licenses. A master’s degree will follow and, possibly, a second BTS. We will thus build a complete training course for real estate and city professions..

Inovista is undoubtedly the first company to advocate working with music. Ten playlists are available on Spotify…

Music has long been part of urban life. We said to ourselves, at Inovista, that it would be fun to offer playlists related to the world of work : move, celebrate an event, work in music, etc. I found the idea quite good. At the request of my team, I made my own playlist to share a little of what drives me. These playlists are public.

You like working in music ?

Yes, a lot, either at the office, either on the move. I listen to Internet radio. In Saint-Denis, I appreciate the 100% Jazz station. Music relaxes me between my appointments. It gives me moments of escape, breathing, small air bubbles.

Vincent Le Baliner, real estate intelligence