To optimize the profitability of its real estate assets, the formation of a family SARL can be a particularly interesting solution. Claire Muller and Frédéric Thienpont, partners Walter France, decipher the issues.

Different types of rental exist for real estate

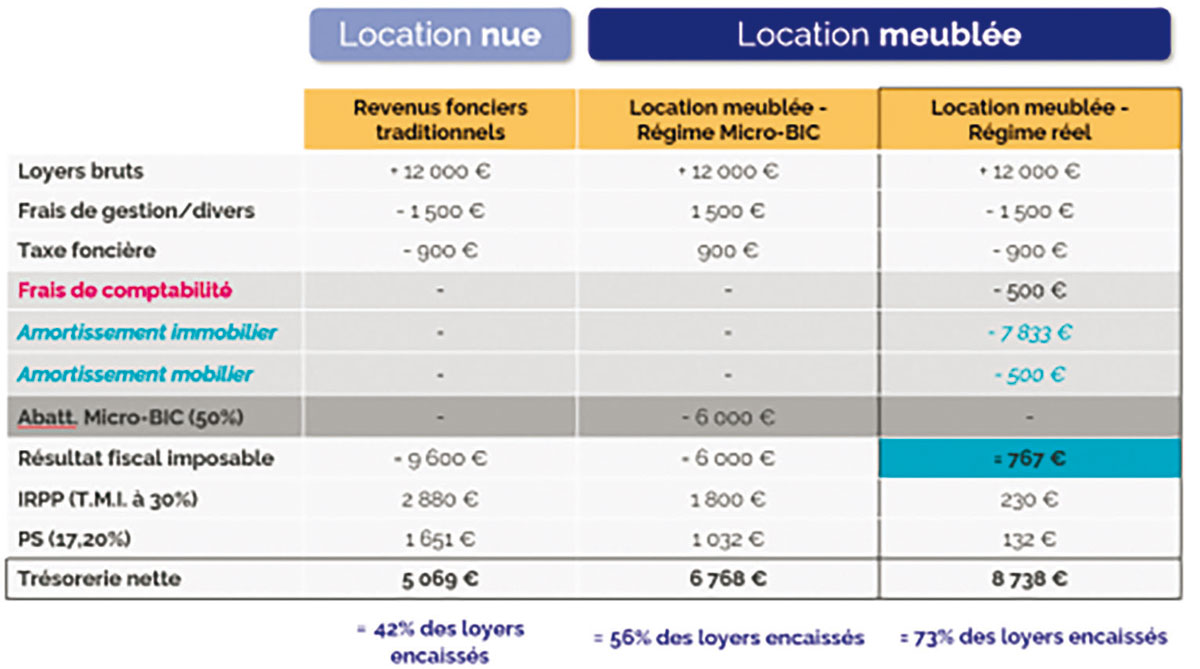

Furnished rental consists of renting a property with all the furniture necessary for living. Non-professional furnished rental (LMNP) and directly, the most common, consists of renting your furnished property yourself, however other solutions exist including furnished rental through a family SARL. The table opposite demonstrates the interest of furnished rental, for which one can choose between two tax regimes : either the micro-BIC diet (industrial and commercial benefits), which will allow you to benefit from a flat-rate tax reduction of 50% to determine the taxable tax result, or the real regime, where the owner will deduct his real costs and will be able to depreciate his property. Taxation is the same, it’s the tax base that changes. This table demonstrates the interest of furnished rental under the real regime, where the owner receives 73% of the rent collected.

The opportune choice of the family SARL

The family SARL is one of the most suitable companies for carrying out a furnished rental activity., because this structure allows you to opt for the partnership regime; clear, opt for tax transparency, unlike a classic SARL subject to corporate tax (IS). This means that the family SARL does not pay IS, but it is the partners who pay, each for their share, income tax as would be the case for individuals who hold the property directly. IR taxation is preferable to IS taxation for this type of investment due to the calculation of the capital gain. IS taxation being much heavier than IR taxation in the event of resale of the property after a certain time.

A strictly commercial activity

However, so that this income tax option is admitted by the tax administration for the family SARL, it will be necessary to respect a certain number of conditions, in particular the exercise of a strictly commercial activity (such as furnished rental) which should not be mixed with civil activity (rental to oneself without compensation, holding of securities, etc.) within the structure. Attention : the exercise of a civil activity - even an accessory one - within the SARL would lead to imposition of corporate tax unless this activity is inseparable from the commercial activity (ex. : rental of a parking lot concomitant and necessary for the rental of the property).

The conditions for creating a family SARL

An SARL can be “family” provided that each partner is directly linked to the others either by direct or collateral ties up to the second degree, either by a matrimonial bond. These conditions must be met at the time of notification of the option to the tax administration., and during all the years for which the company claims to benefit from this regime.

Important legal consequences

Carrying out a furnished activity within the structure will result in legal consequences to be anticipated.. Indeed, the major advantage of furnished rental comes from the possibility of depreciating the property and thus significantly reducing the taxable income tax base. However, these depreciation will be deducted from the profit and will also reduce the profit distributable to the partners. The company will therefore have cash that the partners will not be able to use in the distribution of dividends.. Likewise, the low profit

PLUS-VALUE, TRANSMISSION, DISTRIBUTION OF RESULTS

The added value constitutes the big advantage of the family SARL

In case of sale, and in the specific case where the partner is considered a non-professional furnished rental company, the tax will be according to the regime of real estate capital gains for individuals. The capital gain base benefits from a reduction of 6% per year from the sixth to the twenty-first year, then 4% for the twenty-second year. Exemption is total after 22 years of detention. When the capital gain is greater than 50,000 euros, a surcharge applies. Finally, the tax base for social security contributions also benefits from progressive reductions, with total exemption after thirty years of detention.

The transfer of goods is optimized

Another of the main reasons why the family SARL is interesting is that it makes it possible to optimize the transmission. This is all the more true in property dismemberment, when partners (usually the parents) hold the usufruct and others (usually children) hold bare ownership. Indeed, the tax base decreases, because it is only the value of the bare ownership that is taxed. Transmitting the shares of a family SARL costs less than transferring a building directly : and directly, we only transfer the assets, that is to say the good, while by transmitting the shares of the SARL, we transfer the asset (good) and the passive (loan, partner current account, debts). By subtracting liabilities from assets, the shares will often only be worth the amount of the initial share capital. Depreciation is deductible to IR throughout the rental (regardless of transmission or death), but the interest of the family SARL consists in the fact that the parents can start the transmission and give bare ownership to the children without losing any depreciable basis.; whereas if the property is held directly and bare ownership is given to the children, the property is only depreciable up to the value of the usufruct.

THE FINANCE BILL AND THE LMNP

Certain measures in the Finance bill concern non-professional furnished rentals. Thus the government clearly confirms in the Finance bill that it is impossible for a family SARL to use the Dutreil pact., very favorable tax system allowing the transfer of a business on the basis of 25% of its value. The Finance bill also provides for the modification of the micro-BIC reduction for rentals classified as “furnished tourist accommodation”., which would go from 71% to 50%. Tax exemptions for furnished rental of part of your main residence would be extended until 2026.