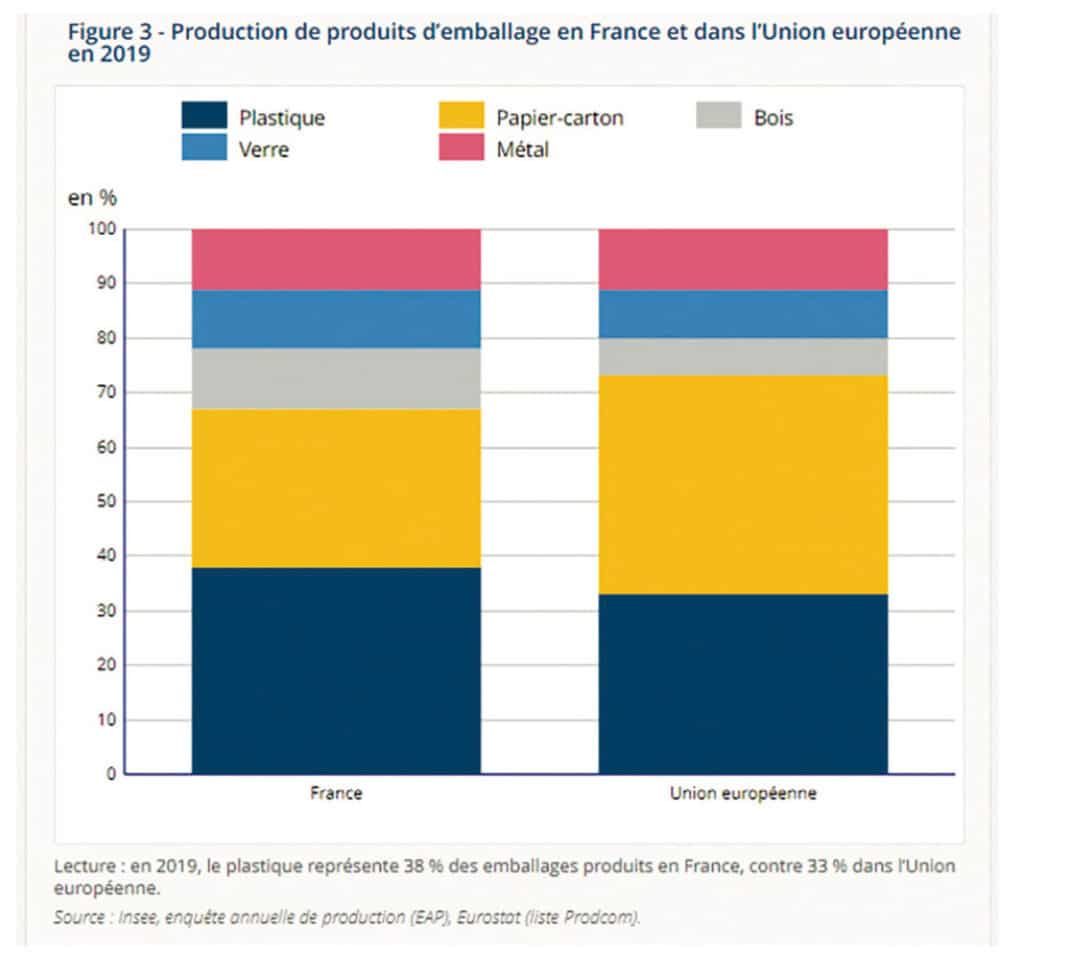

While paper packaging- cardboard occupy first place on a European scale, the production of plastic packaging remains dominant in France.

With a turnover of 18,3 billion euros in 2019, France is the third largest European packaging producer in 2019 (13% of production) behind Germany (20 %) and Italy (15 %)*. However, only wooden packaging is exported more than imported in France. Other types of packaging are in deficit and must be partly imported : -1,1 billion euros for paper and cardboard ; -0,5 billion euros for plastic ; -0,4 billion euros for metal and -7,3 million for glass. Sales in this branch of activity mainly come from plastic packaging. (6,9 billion euros, 38% of sales), followed by paper-cardboard packaging (5,3 billion, 29% of sales), then metal packaging, glass and wood (2,0 billion each, 11% of sales). The packaging industry in France, all sectors combined, forecasts market growth of around 2% per year on average by 2025.

Many small businesses

The French packaging production sector employed 79,450 employees in 2017 (4,7% of jobs in the non-food manufacturing industry)**. Packaging production is a fairly automated labor industry, particularly with regard to wooden packaging (70% of establishments have fewer than 20 employees) and, to a lesser extent, plastic packaging (39 %) and cardboard packaging (37 %). Metal and glass packaging industries have more large establishments.

Cardboard packaging, number one in Europe

France holds first place in Europe in the manufacture of wooden packaging with 20% of invoices and second place for plastic packaging with 15% of invoices.. Its contribution is more modest in the manufacture of paper-cardboard packaging. (10 %, half as much as Germany). While in France, plastic packaging is the main production, and Europe, it is cardboard packaging which represents the largest share of billings : 55,5 billion euros, i.e. 40% of the branch’s sales. In Germany, paper-cardboard and plastic packaging dominate and the country is also characterized by a high production of metal packaging. In Italy, paper and cardboard production represents the largest share of sales : the country occupies second place in Europe, behind Germany, for this type of packaging.

The ecological argument under surveillance

Regulations are tightening on the ecological arguments that more and more brands are including on their packaging or in their advertising.. Since January 1, 2023, advertisers claiming that a product or service is “carbon neutral” must be able to prove it.

The fine for lack of proof promises to reflect the public's sensitivity to the subject, directly linked to global warming : 100 000 euros. This regulatory provision adds to the hunt for ecological arguments that do not correspond to the reality of the actions undertaken. : the consumer code includes greenwashing among deceptive commercial practices. An advertiser lacking proof can be taken to court. Ademe even wants to go further in regulating greenwashing. In a note dedicated to the new regulations in force since January 1, the environment agency explains that it is aiming to ban the use of the term “carbon neutrality” from the advertising lexicon which it considers abusive. “On a marketing and communication level, the abusive and undue use of the “neutrality” argument is problematic : it misleads the public by definition. It is based on the concept of compensation, which covers different realities”, denounces Ademe. With the further consequence of preventing the identification of companies that are committed to and truly take into account ecological issues in the design and manufacturing of their products..