industrial and commercial Petfood Run

In ten years, the Kanéo brand has conquered the hearts of Reunion Islanders by carving out a large share of the dog and cat food market. Quality, circular economy, preservation of the environment and local roots explain this 100% Reunion success story, which continues with the installation of a first kibble distributor.

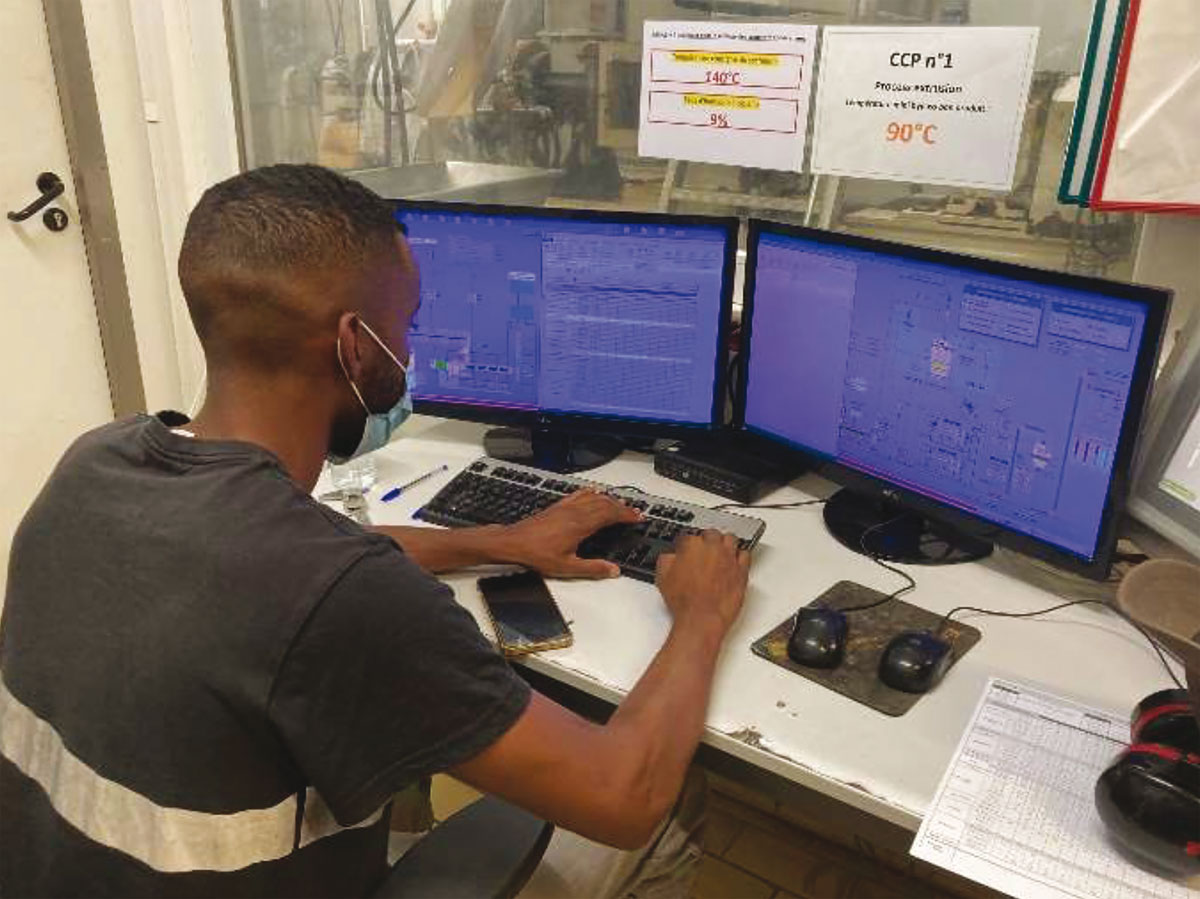

The Kanéo brand is a success of Petfood Run, local company that launched into pet food production in 2013 at a time when the sector was 100% dependent on imports. Thinking in a dynamic of local production, to develop new know-how in Reunion by promoting co-products from the Reunion poultry industry, Petfood Run remains the only kibble factory in the French Overseas Territories. It is still the property of its founding agricultural cooperatives. (Reunion Island Pig Producers Cooperative, CANE, Terracoop and Sicalait). Factory, which today has 22 employees recruited locally, was able to develop new skills and expertise in the region. It's September 2014, after a careful phase of industrial testing and product formulation, that the first premium quality Reunionese croquettes from the Kanéo brand were marketed. In a kibble market which is around 15,000 tonnes per year, the Petfood Run factory produces 4,500 tonnes, including more than 2,000 tonnes for the Kanéo brand alone.

The valorization of local poultry and rice co-products

Ten years after their launch, Kanéo kibbles are chosen by 30% of Reunion consumers to feed their pets (IPSOS study 2021). This choice is explained by the preference for a local brand, perceived as a guarantee of quality. Kanéo is also recognized as a brand promoting a departmental circular economy and contributing to the preservation of the environment through short supply chains and the valorization of local poultry and rice co-products.. Kanéo kibbles are made from dehydrated animal proteins, cereal, minerals and vitamins, whose traceability is guaranteed. Recipes are designed by veterinarians and canine and feline nutrition experts. Petfood Run currently offers more than 40 local kibble references, including 20 under the Kanéo brand, thus offering a range of substitution solutions for imported products, with all the advantages associated with them : local employment, less sea freight, freshness of products and better value for money.

LE TICKET D’OR : TEN YEARS OF CROQUETTES

On the occasion of its 10th anniversary and to thank the people of Reunion for their unfailing support, Kanéo hid a golden ticket in 10 bags of Kanéo kibble. The winners will win ten years of kibble for their pet.

Kibble dispensers : one more step for the environment

Petfood Run is putting into service at the end of the month a first distributor of bulk dog and cat food in the parking lot of a service station in the West. Around ten devices should eventually cover the territory.

Customers will be able to stock up on canine and feline food 24 hours a day, seven days on seven. The operation of the dispenser will be simple : the customer brings his container, selects the type and quantity of kibble desired, then he makes the payment by bank. The kibbles are stored in three airtight hoppers with a total capacity of approximately five tonnes.. The temperature and humidity of the container are monitored and controlled to guarantee optimal conservation of the products. This first distributor will be in the testing phase in the West within a month. “Thanks to bulk, kibbles will be 10% to 15% cheaper, and the distributor responds to a demand from consumers keen to limit their packaging and have access to products outside store opening hours.", underlines Soizic Perrineau, Director of Industrial and Commercial Operations at Petfood Run.

Carrefour Companino : limited edition toys for dogs and cats

Created in 2021, the Carrefour Companino brand meets the needs of pets. With 350 products, Carrefour Companino is the first own brand to offer such a comprehensive range of pet food, which is available in four ranges. : Vitalive, a range of quality meals, complete and balanced at affordable prices ; Naturally, a range of foods based on ingredients of natural origin for a healthy diet ; Expert, a range meeting specific needs, with veterinarian-approved recipes ; Supreme, a premium range with delicious and refined recipes. This year, the brand is offering a limited edition of twelve toys for dogs and cats. : sprinting mice, fishing rod, sports mats, griffoirs, balls, various games, bandanas and t-shirts for animals.

Friskies : a new range of kibbles in small formats

The Friskies brand is relaunching its entire range of cat food, with new recipes and formats of less than 5 kg, more consistent with the habits of cats and better suited to establishment in supermarkets.

There is no shortage of reasons why the historic Friskies brand has been given to cats for over fifty years. A 100% complete and balanced recipe for healthy cats, from kitten to senior cat. A taste loved by cats, guaranteed to please them every day. Optimal nutrition adapted to the size and life stage of the animal. So, with its 54 years of expertise, its 97% notoriety (in France among cat and dog owners, source Ipsos) and its innovations, the Friskies brand, who knew how to evolve and reinvent himself, can claim to have been feeding happy, healthy cats with tasty food for generations, complete and balanced. The essential brand innovates again, today, in the petfood aisle in the cat and dog segment. Friskies communicates around 5 promises that meet consumer expectations (nutrition, quality, expertise, traceability, packaging) and is committed to supporting sustainable agriculture.

EIGHT NEW PRODUCTS FOR ALL TASTES IN THE DRY CAT SEGMENT :

“Friskies Adult cat beef chicken vegetables”, in 6x1 format,5 kg, beef and chicken mixture with vegetables. “Friskies Adult cat rabbit chicken vegetables”, in 6x1 format,5 kg, are another delicious mix of rabbit and chicken with vegetables. “Friskies Adult cat salmon vegetables”, in 6x1 format,5 kg : the delight of the mixture of salmon and vegetables. “Friskies Adult Cat Chicken Vegetables” and “Friskies Adult Cat Tuna Vegetables”, both references in 4 x 3 kg format : these two great classics, chicken and vegetables and tuna and vegetables, are among the kibbles most appreciated by all cats. In the specific range, we will find “Friskies Sterilized Cat Lamb”, a format 1,5 kg : high quality meat for these kibbles intended for sterilized cats (also available with salmon and turkey). There are also two 3 kg formats for sterilized cats : salmon and beef. “Friskies Indoor Cat Chicken and Turkey” and its variation “Friskies Junior Cat (chicken/turkey) » richer in calories to facilitate the growth of kittens, both references in format 1,5 kg.

AN OPTIMIZED ADULT DOG RANGE

Four references from 3 to 12 kg in dry dog range and 2 references in the specific junior range 3 and 7 kg.

PRACTICAL AND NUTRITIONAL BENEFITS

Today, almost 80% of sales in value are made in small formats between 1 and 4 kg. These new formats correspond to purchasing habits. Format 1,5 kg corresponds to a month of kibble ; the 3 kg format, about two months of kibble. These small formats, which optimize the range, also take into account the constraints of displaying products on shelves. The new range of small formats from Friskies is to be introduced in the animal food section for cats among the standard kibbles. The Friskies brand intends to boost this offer in supermarkets by highlighting how this new range of cat food, in addition to its adapted formats, offers animals all the expertise accumulated by Friskies, i.e. everything cats need, whatever their age, their lifestyle or special requirements.

Pet Market : a record year 2023

The Promojardin-Promanimal association reveals the 2023 results of the pet market. Spurred by record inflation, which particularly affected petfood, French people's spending on their animals jumped by 11% in 2023. This unprecedented increase in sales, after two already exceptional years, however, masks a success with many faces. A summary of Échos Études.

The pet market saw further acceleration in 2023. Sales soared by 11%, reaching 6,4 billion euros. If the sector has been growing strongly since the post-Covid period, inflation also played a big role in last year's record performance. Consequence of tensions on supply, the cost of animal feed in particular has reached record highs. On average, the price increase for cat and dog pet food rose to 20% in 2023 on the Promojardin-Promanimal panel. Proof that it benefits from solid fundamentals, the market was also very resilient in volume terms. The number of items sold increased by 1% year-on-year, a figure far from the phenomenon of deconsumption which has affected many other sectors.

A year of contrast

But 2023 was also a year of contrasts. The surge in prices has especially boosted the cat and dog departments, who show spectacular increases in their turnover (+15% and +11% respectively). Real locomotives in the sector for several years, these markets were also the only ones to increase in volume. The other animal families experienced a much more violent decline in the quantities sold., even if for some the surge in prices of cereals and other agricultural products has made it possible to limit the drop in their turnover. This is particularly the case for the bird market., whose sales remained stable in value, rodents, down 2%, and farmyard animals (-3 %). Conversely, other markets such as the aquarium trade suffered from consumer arbitrage in the non-food sector and closed the year with a sharp decline.

A two-speed distribution

On the distribution side, performance was also mixed. The inflationary context mainly benefited supermarkets and hypermarkets, whose sales, largely made up of cat and dog petfood, rose 15%. Pet stores, still in conquest with numerous store openings, also show record results. Garden specialists (garden centers and agricultural self-service stores), on the other hand, were more penalized by the weight of non-food in their product mix and ended the year with a slight increase. E-commerce, for its part, maintained a 15% share in purchases of animal products. It not remain that, beyond inflation, the animal market remains driven by promising underlying trends : the increase in the population of cats and dogs in France, the move upmarket of the offer (more natural products, more technological…), the increasing attention paid to the well-being and comfort of their animal by owners.