Nearly six billion cans were produced in France in 2022. Annual figures from GIE La Boîte Boisson, which brings together the three main beverage packaging manufacturers present on French soil*, once again show a booming market in France as in Europe.

The can is attracting more and more brands

The can owes this success to its many advantages in line with the expectations of consumers and brands.; made from a permanent material, l’aluminium, it is ultra-light, unbreakable and easily recyclable. Produced in France in eight out of ten cases, she is also, 360 degree printable, a source of creativity for brands. These advantages are attracting more and more brands which are shaking up the codes of traditional markets with the can.. So the offers of wines and specialty beers in cans continue to multiply on the shelves. Recently, the waters have joined the trend.

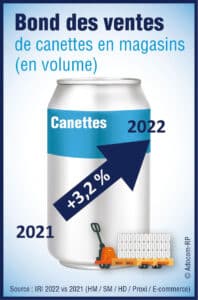

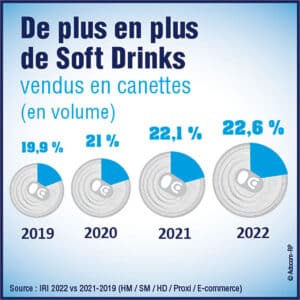

The increase in can sales is driven by the success of soft drink cans, which continue to gain market share from other beverage packaging. In 2022, their sales increased by 5,7% by volume. Value, the can now represents a third of the turnover of this segment. In 2022, the share of cans in sales of soft drinks in stores has increased to 0,5 points to reach the historic share of 22,6 %.

More and more canned water

The growth of soft drink cans is driven in particular by energy drinks, Who

More than two out of ten beers sold in cans

In 2022, 22,4% of beers purchased in stores were in cans. Despite the general decline in beer sales (-1,8 %), the can is gaining market share in all

In details, it is in hypermarkets that cans record the strongest growth with +7,2% of beverage sales by volume (4,1% for the entire market). In local stores, its sales in volume increased by 6,5 %. Also in e-commerce, the bobbin recorded an important performance with +6,4% sales by volume (2,7% for the entire market). Finally, can sales have also grown faster than the supermarket drinks market : +2,8% versus +0,7 %.