Unknown shrinkage has represented considerable figures for several years. Faced with this problem, Philippe Gervais, the president of CashMag, leading French player in coin acceptors and collection and management software for local businesses, offers solutions for merchants.

Shrinkage is the difference between the theoretical turnover and the actual turnover of a company. for example, in 2014, with losses estimated at more than three billion euros, she represented in France, according to the newspaper Le Figaro, 35% of annual business losses ! In addition to significant deficits, shrinkage can also create an atmosphere that is difficult to promote productivity and professional development within the company., thereby affecting team productivity. CashMag offers five tips to help bosses and managers find serenity and team spirit within their company.

Foster a relationship of trust with employees

Mutual respect and trust are the foundations of a healthy relationship between employees and employers. A study conducted by Hollinger and Clark on 12,000 employees in the workforce showed that the happier the employees are at work, the less likely they are to get involved in fraudulent activities. CashMag advises fostering a relationship based on respect and trust, this will significantly reduce the risk of fraudulent behavior.

Rigorously select new employees

Choosing your employees carefully from the start of an employment contract is essential. CashMag recommends that merchants conduct background checks on new employees by contacting their previous employers. This approach helps avoid possible problems of theft or fraud that could be found in their previous jobs.. By improving the selection of its employees, the merchant considerably reduces the risks of internal misappropriation of cash.

Be vigilant and supervise the team

Studies show that supervision is a key element in preventing shrinkage. Proactively, without exercising excessive surveillance over its employees, it is important to remain vigilant and regularly check their activities. CashMag also recommends having more than one person handling the cash register to limit risks..

Set up precise collection rules

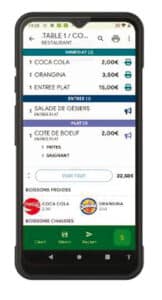

Clear and precise cash register processes limit the room for maneuver of malicious employees and also reduce the risk of unintentional cash register errors.. CashMag advises merchants to implement strict cashout rules, such as cross-checking cash registers and sales records, to avoid losses and limit the risks of fraud or cash errors. This will allow merchants to better manage their cash flow and improve their profitability..

According to Philippe Gervais, “Companies equipped with a coin mechanism see a considerable reduction in shrinkage, which can represent 20 to 50 euros per day per unscrupulous employee. » Instead of investing in surveillance systems, CashMag offers merchants the option of an automatic coin changer. Employees no longer have access to cash, which eliminates the risk of direct theft from the cash register. This allows the