As part of the ongoing negotiations on the dock dues regime, the European Commission wishes to withdraw the protection provided by dock dues when local production provides more than 90% of the needs of the local market, i.e. less than 5%. Gathered at a press conference on January 20, Daniel Moreau, President of ADIR and Haroun Gany, first vice-president of the CCI Réunion called on the government to firmly combat this initiative deemed disastrous for local production and employment. The outright withdrawal of this proposal is requested.

Every seven years, France must ask Brussels for the right to exempt local production from the payment of all or part of the dock dues. It is this negotiation that is underway, all other aspects of dock dues falling under national law. The French request takes the form of a list of customs codes whose production is ensured locally, list that the single-region collectivity forwards to the Ministry of Overseas, in turn, forwards it to the Commission. The latter then examines these requests one by one.. It ensures that dock dues exemptions are justified and proportional to the additional costs incurred by local production compared to the equivalent imported product. This analytical work is carried out on the basis of precise figures. At the end, the Commission proposes a Decision to the Council, that is to say to the governments of the European Union, which formally authorizes France to apply these tax exemptions for local production. It is within the framework of this preparation that the Commission proposed to France that all customs codes representing local production less than 5% of local needs or greater than 90%, could no longer be protected by the dock dues. This is an innovation on the part of the Commission, this principle not appearing in any Decision in the past.

Local production and employment would be weakened

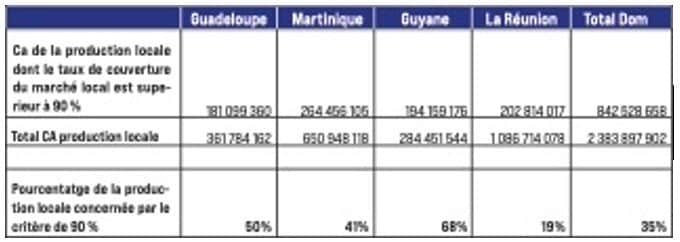

To cushion the shock, the Commission ensures that all requests for exceptions to this general principle will be accepted, i.e. customs codes above 90%, or less than 5%, will continue for the moment to benefit from the protection of the sea dues by way of derogation. However, the Commission would like the principle of non-protection to be enshrined in the Decision. But for ADIR, "If the Commission is ready to give all derogations to the new principle it wishes to establish, as much to directly remove the inclusion of the principle in question in the Decision it is preparing. If she does not comply with this request, it's good that she intends to use it. The Commission is proceeding with a strategy of "small steps", which will lead fairly quickly to an unprecedented weakening of the protection of local production afforded by dock dues. "If the principle proposed by the Commission were indeed applied, the impact on local production and employment would be very significant. The protection of dock dues would be withdrawn from companies representing 50% of local production in Guadeloupe, 41% of local production in Martinique, 68% of local production in Guyana, and 19% of local production in Réunion. ADIR considers the application of this principle as a “gift” of 150 million euros for the benefit of imports, that is to say 35% of the 450 million euros represented by sea dues exemptions for all of the French Overseas Territories. "It is illusory to think that local production could withstand such a loss of competitiveness in relation to imports. In these conditions, nearly 17,000 jobs would be lost, them too, at risk. »